Invoice Detail Adjustments

Invoice Detail Adjustments allow the user to adjust line items on an Invoice. Invoice Detail Adjustments impact Sales and G/L for the current period. This document will take you through the steps to post an Invoice Detail Adjustment and illustrate the resulting effects on the Customer Invoice, Account Inquiry and Reporting. Also See Related Topics.

Note: Invoice Detail Adjustments can be created with an optional Credit Memo. Click Credit Memo for instructions.

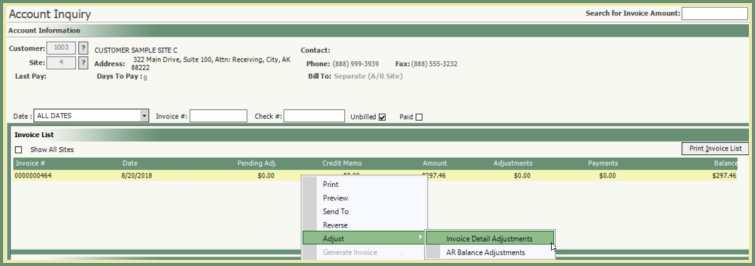

Navigate To: Accounting>Account Inquiry

Invoice Detail Adjustments

- Enter or Search Customer/Site number OR Enter Invoice number to be adjusted in the Invoice # field.

- In the Invoice List, right click on the Invoice to be adjusted.

- Select Adjustment>Invoice Detail Adjustments

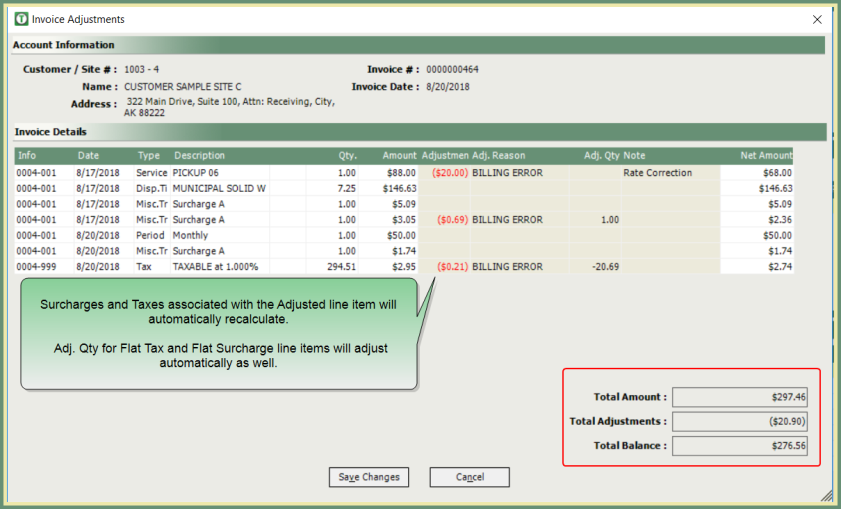

- Invoice Adjustments window will open. Each line item contained on the invoice will be listed in the Invoice Details grid.

- Click in the Adjustments field beside the line item to be adjusted. Click Me For A Tip!

- Enter the Adjustment amount as positive or negative.

- Select an Adj. Reason from the drop down menu.

- *Adj. Qty is only applied when Flat Tax or Flat Surcharge exists on an Invoice. The value for this field will default only when Flat Tax or Flat Surcharge exists but can be changed by the user if needed.

- Note field entry is optional, but recommended for future reference.

- Verify the Total Adjustments and Total Balance.

- Save Changes.

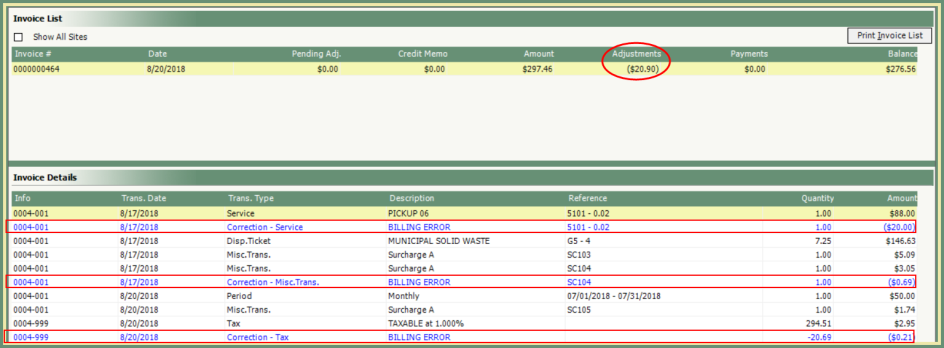

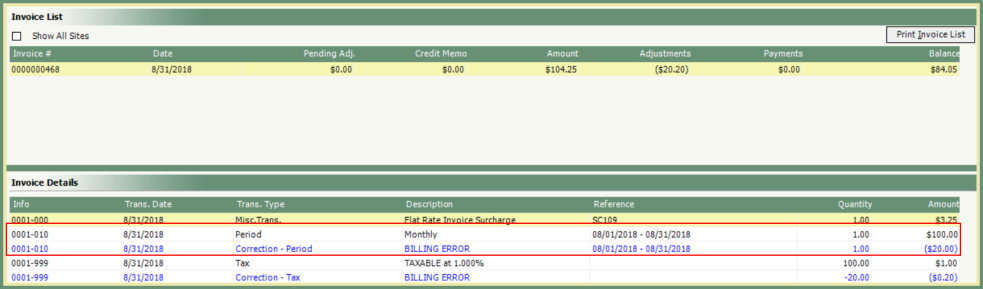

- Invoice List will display the Adjustment amount and the Balance will reflect the adjustment amount.

- Invoice Details will display each Invoice Detail Adjustment line item.

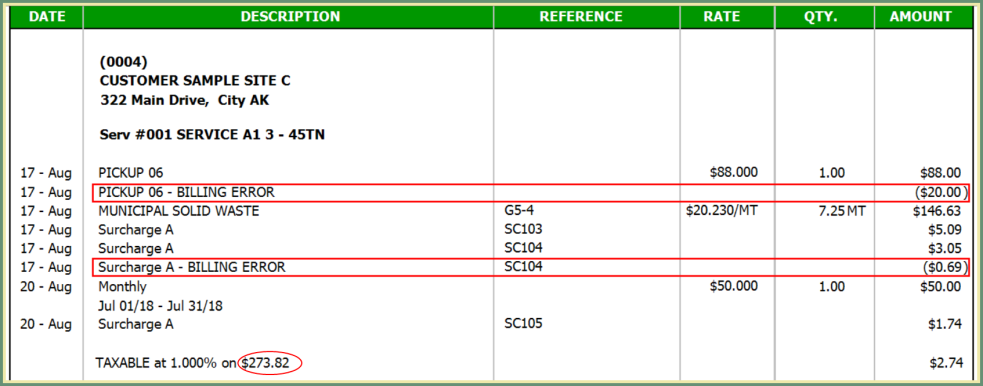

- If Credit Memo's are NOT utilized, the Invoice Detail Adjustments are displayed in the body of the invoice below the adjusted line item.

- The Tax is now calculated on the new invoice balance.

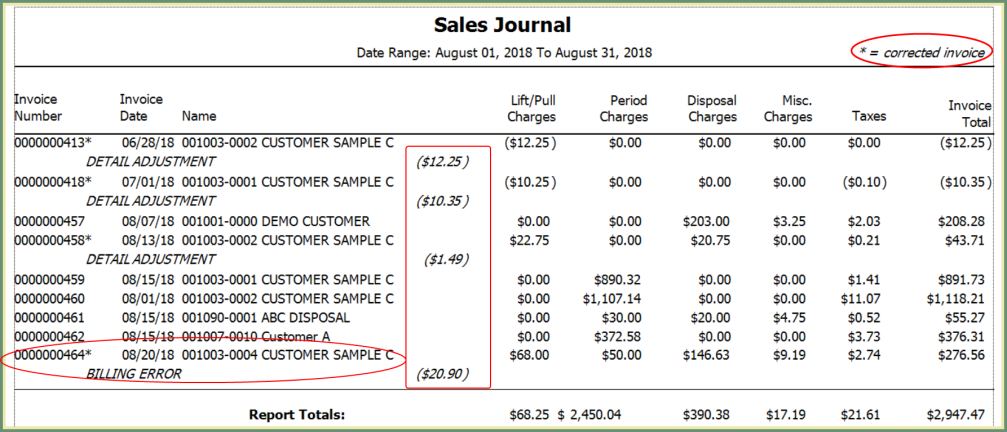

Sales Journal

- Sales Journal will include all Invoice Detail Adjustments posted for the period reported.

- Corrected Invoices include an asterisk(*) after the Invoice Number.

- Adjustment Reason and amount will be listed below the Invoice.

- Invoice Total will reflect the invoice detail adjustments.

The below example is displayed in Detail

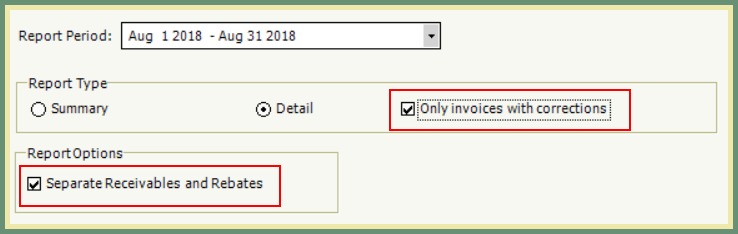

- When the Sales Journal is run in Summary or Detail, there is an option to Separate Receivables and Rebates. This option will report Receivables and Rebates in separate groups.

- When the Sales Journal is run in Detail, there is an option to report Only invoices with corrections. This option will only report invoices that include and Invoice Detail Adjustment.

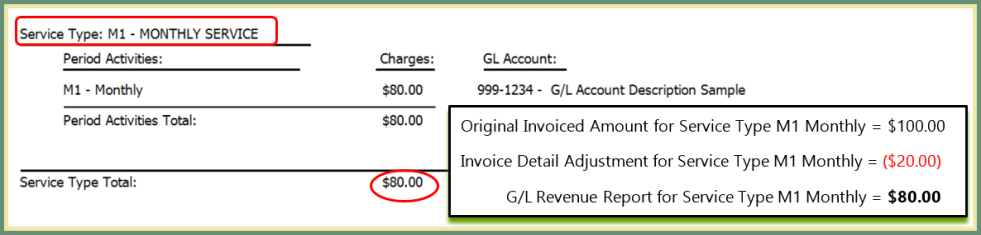

G/L Revenue

- G/L Revenue includes Invoice Detail Adjustments in the Charges.

See the below example for Service Type M1 - Monthly Service:

AR Balance Adjustments from Account Inquiry